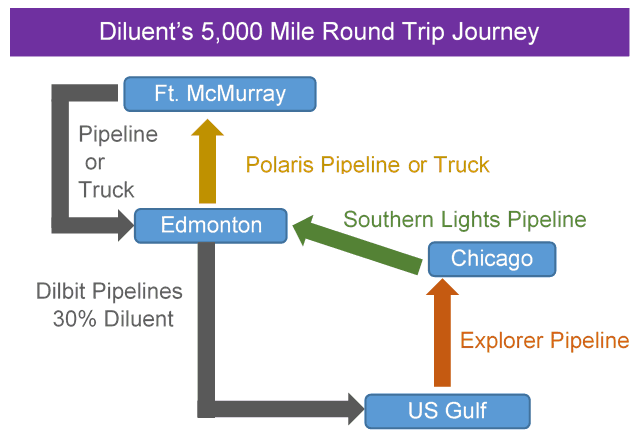

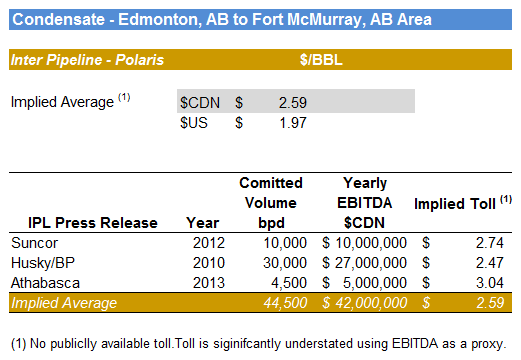

One way to understand this differential is to look at the cost to transport diluent from the USGC to Edmonton. The cost to buy diluent in Edmonton should at least be the cost of diluent in the USGC plus the cost of transport on the pipelines to get the diluent to Edmonton.

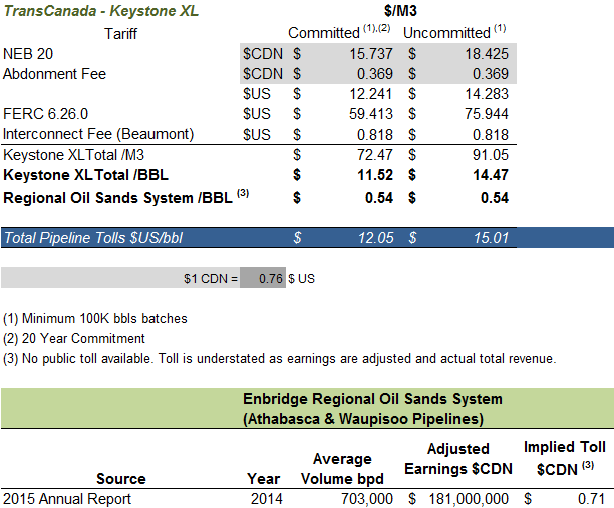

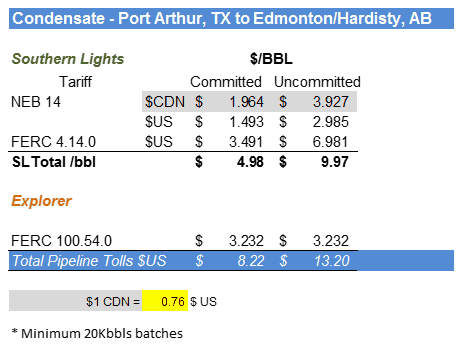

For example, if condensate sells for $50 US/bbl in the USGC then it should sell for at least $50 plus the pipeline tolls shown in the chart here plus the terminal costs and losses.

Notice that there are two rates. One for committed volumes over typically 10 – 20 years and one for uncommitted volume. The rate is exactly double for uncommitted volume. In each case, the minimum daily batch is 20,000/bbls per day which would require about 67,000/bbls per day of bitumen production to blend with on a 30/70 ratio.

Since these pipelines and associated terminals costs billions of dollars to build, it should be expected that the differential should also include some return for those who took the risk in committing to this infrastructure.

There are other sources of diluents. Some of these are not pipeline connected and have used rail to bring condensates in from various sources in the US. Recently, more domestic condensate production has become available from rich gas production from areas in Alberta and British Columbia but these are still not sufficient to supply the market and therefore would not set the market price in an efficient market system.

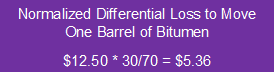

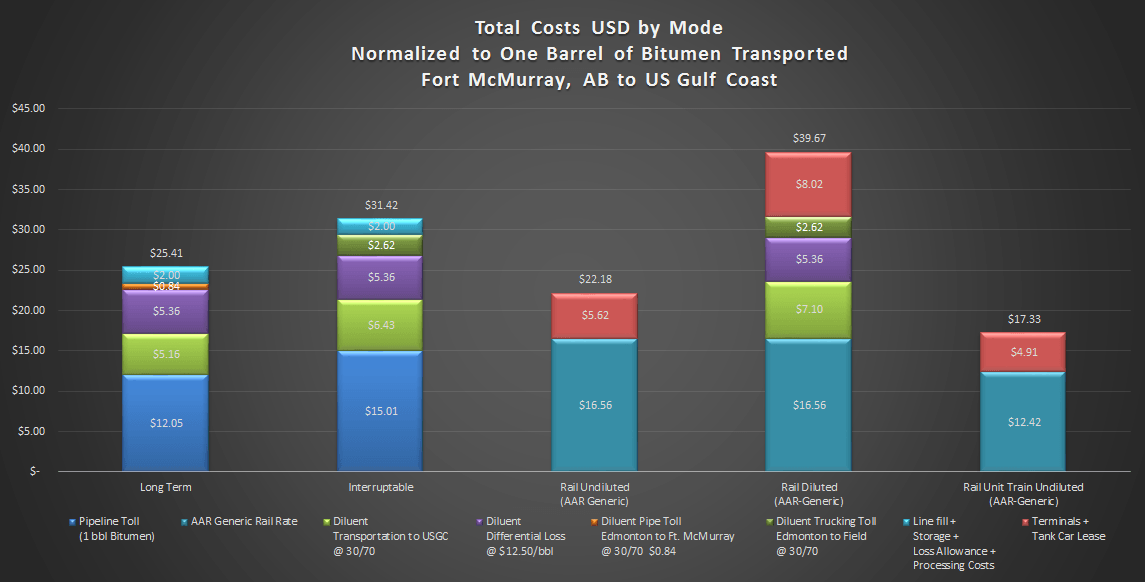

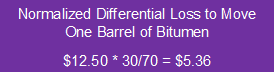

The analysis in the summary chart assumes the differential to be $12.50 US/bbl which would be reasonable over time in an efficient market system. This cost is labelled the “Diluent Differential Loss” in the summary chart. This cost has to be normalized to the cost to move one barrel of bitumen which would be 30/70 *$12.50US = $5.36 US.

The analysis in the summary chart assumes the differential to be $12.50 US/bbl which would be reasonable over time in an efficient market system. This cost is labelled the “Diluent Differential Loss” in the summary chart. This cost has to be normalized to the cost to move one barrel of bitumen which would be 30/70 *$12.50US = $5.36 US.

Of course, the differential loss is set by various market influences and can not be precisely set as a fixed number from a formula. Is does fluctuate up and down based on market and other conditions. However, any differential loss less than the cost to move the diluent would mean the system is inefficient and parties along the logistics chain are losing money.

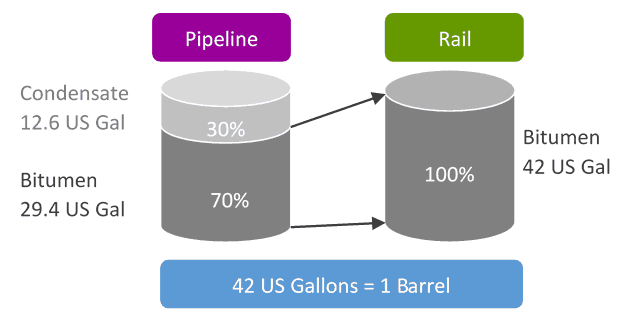

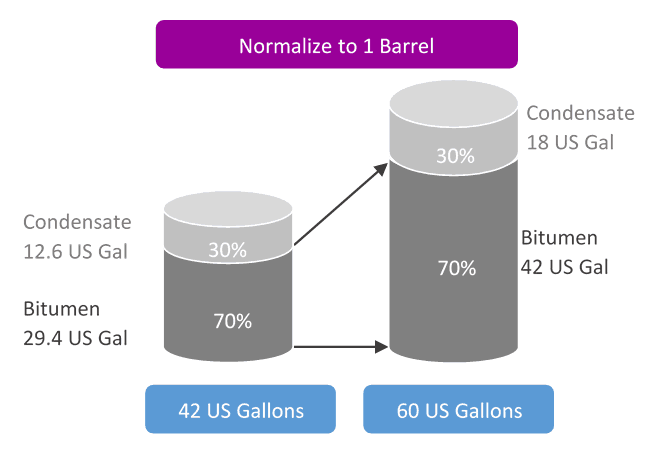

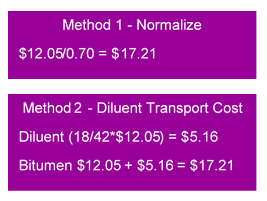

Method 1 is the easiest way to understand. Since a pipeline toll of $12.05 in this blend ratio would only move 70% of a barrel of bitumen, simply divide the toll by 0.7 to normalize to 1 barrel.

Method 1 is the easiest way to understand. Since a pipeline toll of $12.05 in this blend ratio would only move 70% of a barrel of bitumen, simply divide the toll by 0.7 to normalize to 1 barrel.

The analysis in the summary chart assumes the differential to be $12.50 US/bbl which would be reasonable over time in an efficient market system. This cost is labelled the “Diluent Differential Loss” in the summary chart. This cost has to be normalized to the cost to move one barrel of bitumen which would be 30/70 *$12.50US = $5.36 US.

The analysis in the summary chart assumes the differential to be $12.50 US/bbl which would be reasonable over time in an efficient market system. This cost is labelled the “Diluent Differential Loss” in the summary chart. This cost has to be normalized to the cost to move one barrel of bitumen which would be 30/70 *$12.50US = $5.36 US.

Dilbit pipelines require that the dilbit meet certain specifications and in particular, the amount of water that can be part of the dilbit mixture. This means that the bitumen has to go through expensive treatment to remove the water to meet the maximum water allowed in a pipeline of 0.5%. For rail, this is only a commercial consideration not a transportation consideration. The commercial consideration on rail versus the cost of treatment has tended to set the maximum water content on rail at 2%.

Dilbit pipelines require that the dilbit meet certain specifications and in particular, the amount of water that can be part of the dilbit mixture. This means that the bitumen has to go through expensive treatment to remove the water to meet the maximum water allowed in a pipeline of 0.5%. For rail, this is only a commercial consideration not a transportation consideration. The commercial consideration on rail versus the cost of treatment has tended to set the maximum water content on rail at 2%.